Solana Price Momentum Eases as Traders Eye $200 Target Amid Cooling Indicators

Solana (SOL) has delivered a strong monthly performance with a 28.4% gain, briefly touching $184. However, the cryptocurrency’s upward momentum appears to be waning, with just a 0.78% increase recorded over the past week. Despite this pause in price action, Solana’s on-chain activity remains robust, particularly in the decentralized exchange (DEX) space.

DEX Leadership Reinforces Solana’s Ecosystem Strength

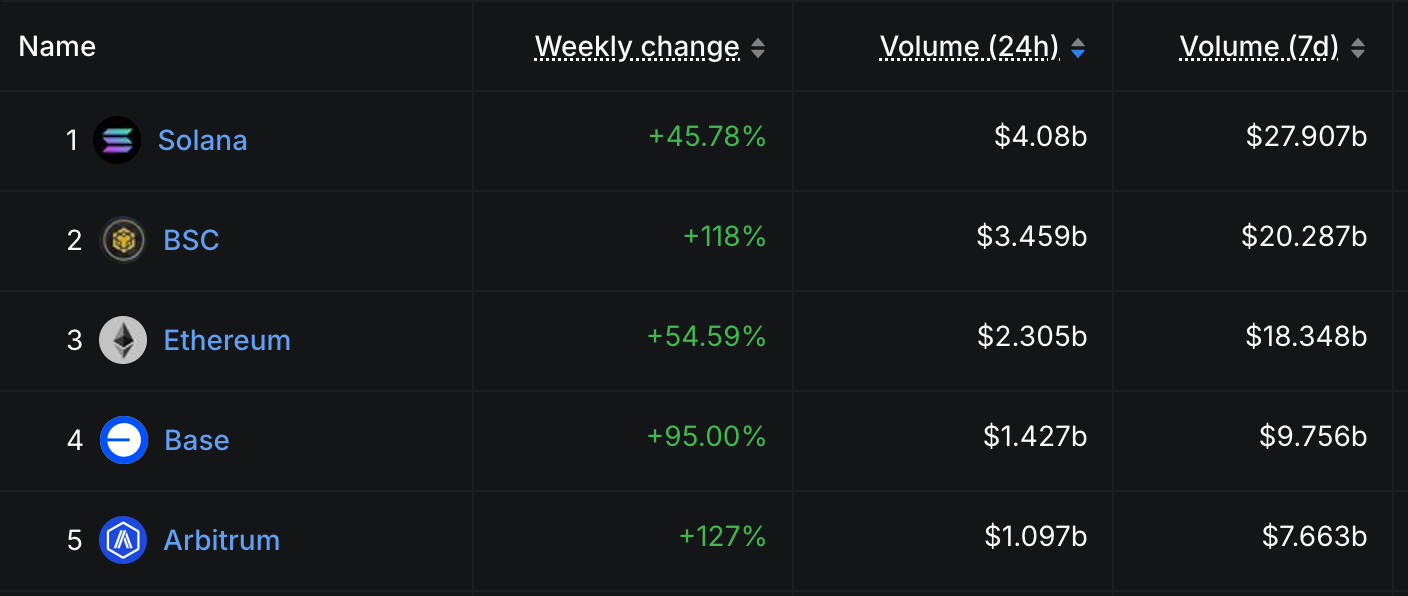

Solana continues to dominate the DEX landscape, outperforming major networks including Ethereum, BNB Chain, Arbitrum, and Base. Over the last seven days, Solana’s DEX volume soared to $27.9 billion—a 45.78% jump compared to the previous week. This marks the fourth consecutive week that Solana has led all chains in trading volume, with activity consistently exceeding $20 billion.

This surge in on-chain volume has been complemented by notable fee generation across the Solana ecosystem. Four of the top ten fee-generating apps in the past week were built on Solana, underscoring its growing relevance in the DeFi space. Among them, Believe App, a new Solana-based launchpad, stood out by generating $3.68 million in fees in just 24 hours—outpacing established platforms like Uniswap and PancakeSwap.

Cooling Technicals Signal Potential Pause in SOL Rally

While fundamentals remain strong, technical indicators suggest the recent rally could be entering a consolidation phase. Solana’s Relative Strength Index (RSI) has declined from 66.5 to 51.99, placing it in a neutral range. Historically, RSI levels above 70 indicate overbought conditions, while values below 30 point to an oversold market. A continued slide below 45 could open the door to further downside, while a move back above 60 may reignite bullish momentum.

The Ichimoku Cloud analysis reflects a similar narrative. Solana’s price is hovering near the Kijun-sen and Tenkan-sen lines, both of which have flattened—suggesting a lack of directional conviction. The Chikou Span still sits above current price levels, maintaining a long-term bullish bias, but weakening proximity indicates fading momentum.

Despite a bullish Kumo Cloud structure offering some support beneath current prices, the lack of a strong breakout above resistance lines raises caution. If the price dips into the cloud zone, it may trigger a more extended consolidation or even a reversal.

EMA Structure Remains Bullish, but Momentum Slips

Exponential Moving Averages (EMAs) still reflect a bullish configuration, with short-term averages trending above longer-term lines. However, the narrowing distance between these EMAs signals a slowdown in upward price pressure. Solana recently failed to overcome a key resistance zone, suggesting that any move toward the $200 milestone may now depend on renewed buyer strength.

Holding current support levels will be essential for preserving the overall bullish outlook. A breakdown could invite increased selling pressure, while a decisive push above the current range may reignite the drive toward the psychological $200 mark.